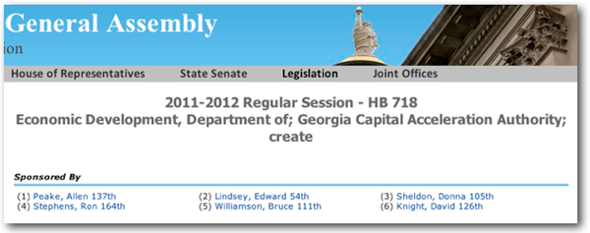

Last week, State Rep. Allen Peake and his co-sponsors dropped HB 718 into the legislative hopper. It’s an effort to put state resources into venture capital, and I think it’s worth supporting. But, like all bills, the legislation is a little hard to read, so I’m translating it into English here.

The impetus for the bill came from a coalition of Georgia angels and venture capital investors, who examined similar programs in other states (notably InvestSC and TNinvestco). You can read the complete text of the Georgia bill as drafted here. I’ve plowed through the seventeen pages of legalese to you don’t have to. Here’s what you need to know.

Invest Georgia Program

HB 718 creates the Invest Georgia program to invest in seed, early, and growth stage companies in order to create Georgia jobs, create wealth within Georgia, commercialize R&D at Georgia’s universities, and promote the economic development of Georgia. (The name in the bill is the Georgia Capital Acceleration program, but that will change.)

A new Invest Georgia Authority (IGA) will consist of five members: three appointed by the Governor, one by the Lieutenant Governor, and one by the Speaker of the House of Representatives. Each member must have experience as a venture investor, fund-of-funds manager, or as an entrepreneur. Members serve without compensation and cannot be affiliated in any way with a fund receiving investments.

The Money

The state of Georgia will sell up to $200 million insurance premium tax credits, with the proceeds going to the new Invest Georgia Fund (IGF). This is a mechanism that has been proven in other states; credits against future premium taxes usually sell for about 85¢ on the dollar, which would nominally deliver $170 million in cash to the IGF (in equal thirds over three years, starting in June 2013). The proceeds will be invested in Georgia-based funds who are investing in Georgia-based businesses.

Administration

Through a transparent open-bid process, IGA will appoint a third-party “program administrator” that will evaluate and select Georgia-based venture capital funds. There are many respected third-parties who specialize in such assistance for other states and other institutional investors. Some of the more well known are Hamilton Lane, LP Advisors, Cambridge Associates, and many others.

Once appointed, the program administrator will conduct a separate transparent open-bid process for funds seeking investment of IGF monies, starting in September 2012. Applicant funds must have a history of investing in Georgia and/or commit to a permanent presence or affiliation in Georgia.

The Recipient Funds

The program administrator will recommend investments in funds that meet the state’s criteria and which cover a broad range of sectors that traditionally are good targets for venture capital and are important to Georgia’s economy, including technology, health care, life sciences, agribusiness, logistics, energy, and advanced manufacturing. (Retail, real estate, venue-based entertainment, financial services, mining, and professional services are specifically excluded.) Final fund selections — but not individual company investments — are approved by the IGA board.

IGF investments into the funds will be made over three years, coinciding with the sale of the tax credits. The allocation will be balanced between:

- 30% into early-stage venture capital funds, including first-time funds. IGF can account for up to 90% of the capital in such a fund, with the remainder coming from the principals and other investors. “Seed” or “early-stage” companies must have fewer than 20 employees and revenues of less than $1 million. Early-stage allocations will be between $10 million and $15 million per fund.

- 70% into growth-stage venture capital funds, where IGF can account for up of 50% of the capital in such a fund. “Growth-stage” companies must have fewer than 100 employees, but revenues of greater than $1 million. Growth-stage allocations will be at least $10 million per fund, with the cap to be determined by the IGA.

Any company receiving investment from IGF monies must be located in Georgia; if it leaves Georgia within three years, the investment must be returned.

Recipient funds will collect an industry-standard management fee and other fees (primarily legal and accounting, but specifically not to include lobbying or governmental relations).

Financial Soundness and Transparency

Investments in companies that are successfully acquired (M&A) or go public (IPO) will return capital to the IGF until it recovers 100% of its committed capital. Afterwards, the IGF and any fund returning capital will split returns: 80% to the state, 20% to the fund. This is a standard venture capital limited partnership arrangement.

Every year, each recipient fund will file a report with the Governor and legislative leaders detailing company names, amounts, and performance of qualified investments; number of Georgia employees and their average wages; and other information required by IGA to determine the fund’s contribution to the economic development of Georgia. This report will be published on a publicly-available website (after removing any proprietary or company-confidential information).

Note that this is not a CAPCO (Certified Capital Company) program such as those adopted (and regretted) by many states. You can read more about CAPCOs in the AJC here, and here, and here, and here.

My standard disclaimer applies. Also note that I am not a lawyer and I don’t play one on television. Any errors in representation above are my fault, and you should read the entire bill before making any decisions as to whether you support it. And, of course, bills in the Georgia Legislature sometimes change substantially between first reading and final passage, even if the bill number stays the same!

[…] Edited: Now proposed as HB 718, Jan 2012 […]