This is a continuation of a previous post and is second in a series.

I usually try to get some audience participation going at this point; unlike the PDFs, the Keynote slides (I don’t use PowerPoint except when forced to) are set to not display the “good news” text until manually triggered; same for the “bad news.” So I try to get the audience to volunteer their ideas for the pros and cons before I show my version.

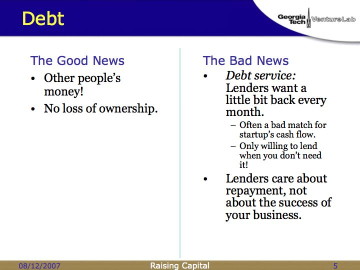

You can read these in the image above, so I don’t need to repeat myself here.

It is worth pointing out that, where I say “Often a bad match for a startup’s cash flow,” the point is that if your startup has any cash available after paying your bills at the end of the month, you probably would rather be hiring an additional engineer, or buying/leasing a key piece of equipment, or signing up a key business partner… not writing checks to the bank.

My friends in the banking business will challenge the last bullet above. I will admit that they would prefer that your business be successful, since that will allow them to make additional loans in the future. But my fundamental point remains: If you take out a 48-month loan, make all your payments on time, clear the debt, then go bankrupt in month 49… from a banker’s point of view, that was a good loan.

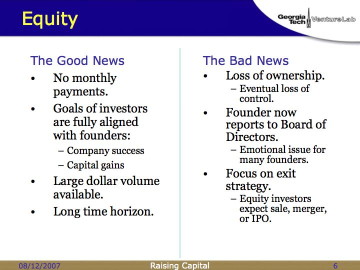

Since equity is what VCs buy, I usually spend extra time on this one.

I’m a big believer in aligning the goals of investors with the goals of the founders. That makes board meetings more congenial, since everyone is trying to accomplish the same thing (ideally, obscene capital gains).

The “long time horizon” on the left is meant to be relative to bankers… meaning you can get VC investors willing to hold your equity for 5 to 7 years before exit (and sometimes they hold it longer than that!). Still not enough for some bioscience opportunities, unfortunately.

The right-hand side is where I can normally expect someone to volunteer that some of the “bad news” about equity is “giving up part of your company.” Then I go into my patented screed on “You’re not ‘giving up’ anything… you’re selling it to me! If you don’t like the price, don’t do the deal!” I’m not Jim Cramer, but I can usually wake up sleepyheads in the audience at this point.

People are often surprised that VCs are thinking about selling your stock even before they write the first check to buy it… selling it to the public market through an IPO (initial public offering), or selling it to another company through M&A (merger and acquisition). But, as we’ll address later, one of the differences between angels and institutional VCs is that the VCs need to give the money back at some point… they can’t hold stock in your company indefinitely.

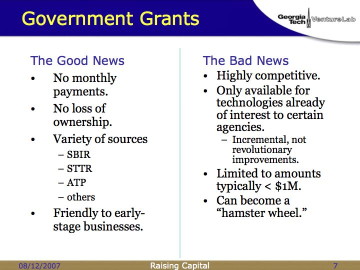

I used to neglect this financing alternative, but now that I have the SBIR Assistance Program reporting to me, it’s risen in my estimation. (Live in Georgia? Want free money for your startup? Check out our Web page here! No Georgia Tech relationship required. We’ll even help UGA graduates!)

For those of you who don’t know… certain agencies of the Federal government set aside certain percentages of their procurements for small businesses. (“Small” to the Feds means fewer than 500 employees!)

On the right-hand side, my “hamster wheel” comment refers to those companies which make their living delivering on one SBIR award after another, without ever breaking out into commercial success. Nothing illegal, immoral, nor fattening about that, and you can make a perfectly nice living that way, but it’s not likely to attract venture capital investment.

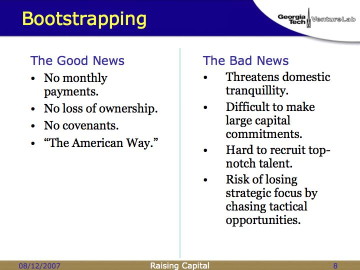

I finish my overview of financing alternatives talking about bootstrapping. It turns out that many foreign-born entrepreneurs aren’t familiar with this term. There is a surprisingly complete page on this topic here (Wikipedia).

On the “bad news” side, I usually get a chuckle when I state “If you bootstrap your startup company, you will get divorced.” It’s an exaggeration, but there’s a very large element of truth in there.

“Difficult to make large capital commitments” — you’re not going to build a chip fab on your Visa card, unless your credit limit is a helluva lot larger than mine.

“Hard to recruit top-notch talent” — an industry leader is probably not going to move across country to join a bootstrapped startup with $17.50 in the bank. Hint: If you’re asked to book your flight for the interview trip using your own frequent flyer points…. don’t.

The last bullet item is a subtle trap for bootstrapped companies. If you want to manufacture carburetors and you’re looking at a missed payroll… and you stumble across a customer who needs automated cheese slicers, you’ll probably say “Yes, I can do that!” From there, it’s a short downward slide to chalkboards, and cotton candy machines… and you find that you’ve completely lost your strategic focus.

Time to catch our breath and switch gears. More soon.