This is a continuation of a previous set of posts and is third in a series.

When I taught a semester in entrepreneurship for the MBA students across the street, I spent an entire 90-minute class on this single slide…

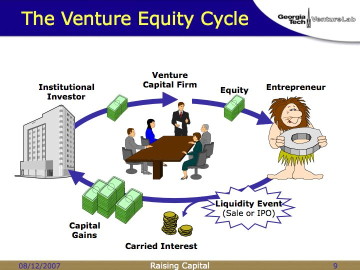

The first thing to know about the venture capital cycle is: it’s not the VC’s money! They like to pretend that it is (I can say that, since I was a VC for almost ten years), but the money belongs to big institutional investors—pension funds, foundations, university endowments, etc. These entities are managing billions of dollars… sometimes tens of billions. They can invest in anything they want, as long as they’re meeting their fiduciary duties. Most of their assets will be invested in stocks, bonds, and T-bills. Boring.

Most institutions will dedicate a small portion of their funds to “alternative assets.” (Except in Georgia. That’s the subject of another post someday.) Usually a single-digit percentage. That includes hedge funds, oil and gas partnerships, real estate, tractor factories in Uzbekistan… and venture capital.

Venture capital is equity investment in entrepreneurship. Our entrepreneur is standing at the right side of the chart, holding his new invention… the very latest in Stone Age high technology.

There’s a problem: the institutional investor and the technology entrepreneur have no way to communicate. They have no language in common. They have no concepts in common. They need a middleman to translate.

That’s where venture capitalists enter the scene. They’re sitting around the table in the middle. (Our entrepreneur, slightly better groomed, is standing and giving his presentation.)

VCs are middlemen.

Their distinguishing feature is that they are able to speak two languages… the language of finance to the institutional investor, and the language of technology to the entrepreneur. That’s actually not a common combination of skills, and sitting at the intersection of those two worlds gives the VC a certain measure of power. Many of them use it for good purposes.

So now let’s look at the cycle. The institutional investors hand a stack of cash to the VC. (Yes, it’s more complicated than that. Come back for the 90-minute version later.) The VCs hand stacks of cash to startup companies. (Purchasing equity; remember the previous section?) We’ll talk in the rest of this presentation about their selection process. Years of hard work follow.

If everything goes well, the company gets to a liquidity event—either through an IPO, or an outright sale of the company (or its assets) to a larger company.

(I usually get a giggle here when I explain how one of my CEOs used to have a hard time keeping his terms straight—he kept telling the board about his plans for a “liquidation event” when he really meant to say “liquidity event.” There’s a big difference! “Liquidation event” is selling off the furniture and fax machines before the sheriff comes to padlock the doors…)

Anyhow, after the sale or IPO, the VCs rake off their “carried interest”… usually 20% of the profits after paying back the original investment. That’s how they buy Ferraris. The bulk of the money goes back to the institutional investors. Closing this cycle usually takes five to ten years, so the proceeds are long-term capital gains. If the institution is happy with the results, they make another investment in the fund, and the cycle continues.

When things break down—as they did in 2001—it gets ugly fast. Institutions stop investing in funds; funds stop investing in new deals, since they are focused on protecting their old ones; the IPO market closes tighter than a drum; VCs don’t get carried interest; and institutions don’t get their distributions. 2002 wasn’t fun for anybody.