So I was teaching a class for Paul Steffes in ECE (Electrical and Computer Engineering) last week. One of the things I love about being on staff at a university is that I can drop in to a graduate class, teach to very smart people for ninety minutes, then leave. As I proved a couple of years ago when I was teaching in the College of Management, it’s a lot tougher when you’re doing it twice a week for sixteen weeks!

Anyhow, I gave a truncated version of my standard “Raising Capital” talk, which I’ve given to any number of audiences over the last dozen years. (Of course, it’s evolved a bit, and continues to evolve. But the core messages don’t change.) A PDF of the most recent version is posted on the Web at www.stephenfleming.net.

One of the students asked if there were a video available. I know I’ve been videotaped at various times and places, but I don’t know what happened to those tapes. And the point isn’t watching me, anyhow, but absorbing the entire message—including what’s not printed in the PDF. That can be done without video.

So I’ve decided to post an annotated version here on my blog. I’ll include scaled-down images of each page, but the PDF is much higher quality.

Cover page. Yep, I work at Georgia Tech. Standard disclaimer: All material in this presentation reflects the personal opinion of Stephen Fleming, and does not necessarily represent the position of Georgia Tech, the University System of Georgia, or the State of Georgia. And that’s a darned shame.

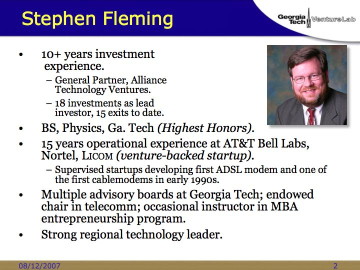

In case you’ve stumbled on this blog and don’t know who I am.

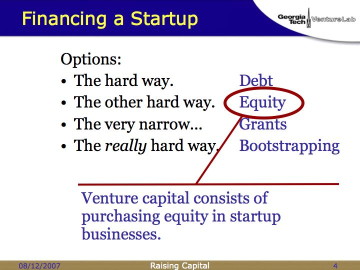

I only know of four ways of financing a startup. (Well, there’s a fifth: luck. Winning the lottery, picking wealthy grandparents, or whatever. But since that’s not reproducible, I don’t count it here.)

All of them are hard. If they weren’t hard, everyone would do it! Some of the ways are harder than others, and all of them have advantages and disadvantages.

By and large, venture capitalists talk about equity. This is not the first definition in the dictionary:

the quality of being fair or impartial; fairness; impartiality

Instead, it’s the third or fourth definition, depending on your dictionary:

the monetary value of a property or business beyond any amounts owed on it in mortgages, claims, liens, etc.

I hate to belabor the point, but I’ve run into cases where entrepreneurs get really confused by the multiple definitions… especially when English is their second (or third or fourth) language.

Anyhow, venture capitalists purchase equity in startup companies… typically in the form of convertible Preferred stock. (You as an entrepreneur get Common stock. Preferred is better. That’s why the VC gets it and you don’t.)

But let’s look at all four kinds of startup financing and see the pros and cons.

I’m going to stop here and start another post.

Edited later:

I have posted a directory to the entire series here.

http://www.freeiq.com/fundingyourstartuphowtobystephenflemingatbarcampatlanta

Andy taped you!

Alas, the audio quality is not so great on the recording posted at FreeIQ.

I was waiting to let you know Stephen until we’d done another pass on post production.

Stephen,

As someone who has gone through the VC system (both successfully and unsuccessfully) – a number of times, your posts are a very valuable insight to this process.

I wish I had this advice when I started on my first venture.

Please keep the commentary coming – I enjoy reading each new weeks post.

Thank you for taking the time to illuminate this subject in so much detail.